The Healthcare BPO industry is a critical support system for the notoriously complex U.S. healthcare ecosystem. It emerged from the need for providers (hospitals, physician groups) and payors (insurance companies) to control skyrocketing administrative costs and navigate an ever-growing web of regulations, primarily HIPAA. The core value proposition is simple: leverage economies of scale and specialized expertise to perform non-clinical, back-office functions more efficiently and accurately than a individual hospital or insurer could on its own.

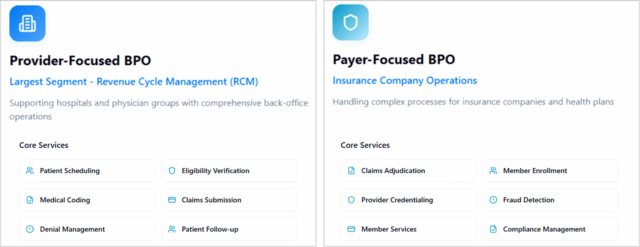

The landscape is broadly divided into two segments:

The market is mature but far from static, currently being reshaped by technological innovation and new financial pressures from emphasis value-based care.

Key Players: Specialized and Diversified Competitors

The competitive field is diverse, featuring specialized firms and massive diversified corporations:

Demand Drivers: Cost, Compliance, Technology Adoption

The demand for healthcare BPO is fuelled by several powerful and persistent factors:

- Cost Pressure: With administrative costs estimated at 25% of all U.S. healthcare spending, the imperative to reduce overhead is immense. BPOs, often operating from lower-cost geographic regions, offer a clear path to significant cost reduction.

- Regulatory and Coding Complexity: The transition to ICD-10 and continual updates to billing compliance rules require highly specialized knowledge. Most healthcare providers cannot afford to keep a large, expert in-house team updated on every change. BPOs make this expertise available on a scalable, variable-cost basis.

- Operational Inefficiency: Provider burnout is exacerbated by administrative burdens. By outsourcing tedious and time-consuming tasks like denials management and follow-up, providers can refocus their internal staff on patient-facing activities and core medicine.

- Access to Technology: Leading BPOs invest heavily in proprietary platforms for analytics, workflow automation, and reporting. Clients effectively “rent” access to this technology without the massive capital outlay and implementation risk.

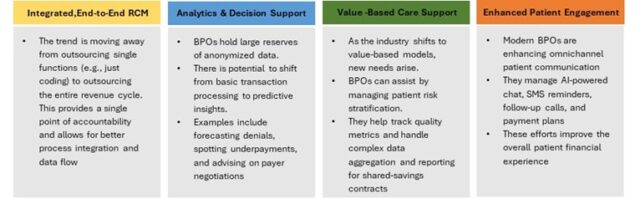

Current Opportunities: Integrated analytics and Engagement:

To stay relevant, BPOs are expanding beyond traditional back-office tasks:

Challenges: Security, Pressure, Integration, Trust

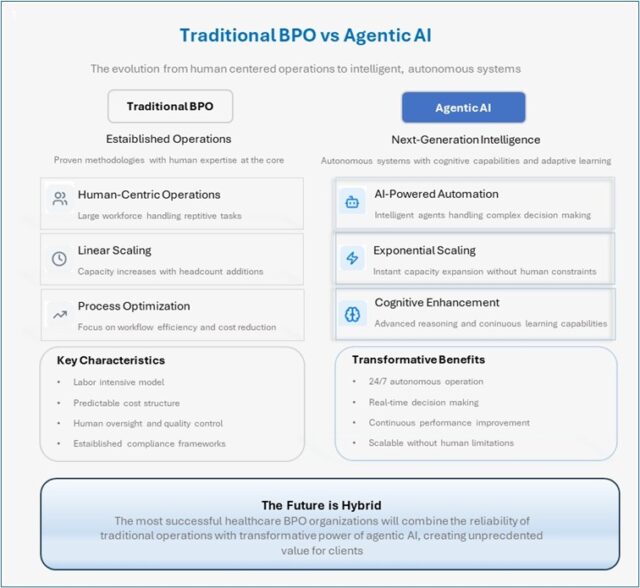

Agentic AI or Traditional BPO: The Battle for Healthcare Efficiency

A high-stakes battle is underway to automate the US $4.3 trillion1 U.S. healthcare industry, which spends nearly US $1 trillion1 annually on administrative costs. The contenders are established Business Process Outsourcing (BPO) firms and emerging AI agent software solutions. The goal is to achieve massive cost savings, address staffing shortages, reduce burnout, and improve care quality.

The winning BPOs will not be replaced by AI; they will become AI-powered. Their path forward is to:

- Integrate AI Agent: Use AI agents to automate the most mundane tasks, boosting the productivity of their human agents by 10x. The human role shifts from data entry to handling complex exceptions and escalations.

- Leverage Their Hidden Asset – Data: BPOs possess vast, labelled datasets that are perfect for training and refining AI models. This data moat is a significant competitive advantage over pure-play AI software startups.

- Shift to Higher-Value Services: With AI handling execution, BPOs can shift their offering to strategic advisory services: managing the AI agents themselves, providing deep analytics, optimizing entire workflows, and acting as indispensable consultants on operational transformation.

- Offer a “Managed AI” Service: Many healthcare providers are wary of implementing unproven AI. BPOs can offer a safe, managed service where they provide the outcomes of automation (e.g., faster reimbursement, fewer denials) without the client having to buy, implement, or trust the AI software directly.

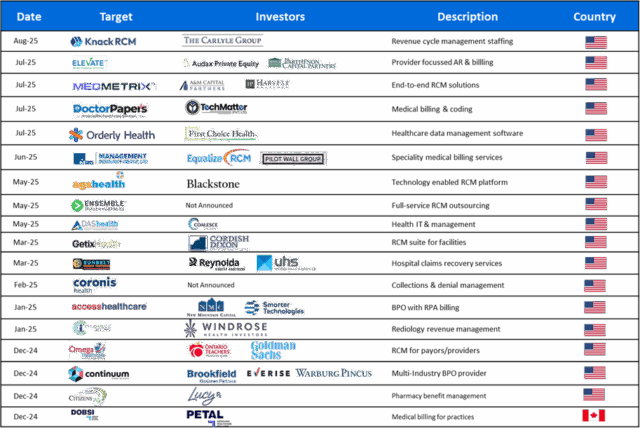

The M&A Angle: AI-Driven Consolidation Transforms the Competitive Landscape

The M&A Angle: AI-Driven Consolidation Transforms the Competitive Landscape

The impact of AI is unmistakable in the M&A market. Strategic acquirers and private equity funds are aggressively pursuing BPO firms with proven AI-driven solutions embedded in their service delivery. In the past, deals focused primarily on expanding client bases or geographic reach. Now, successful acquisitions are centered on embedding automation, predictive analytics, and digital-first tools that reshape core workflows for clients

With several transactions valued at multiples above 18x-25x EBITDA, investors are rewarding platforms that offer scalability and futureproofing through technology. Some of the recent transactions:

At TH Healthcare & Lifesciences, we combine deep sector knowledge with a proven track record in healthcare BPO, AI-driven transformation, and M&A advisory. Whether you are looking to grow through acquisition, drive operational excellence with next-generation technology, or unlock new opportunities in a changing healthcare landscape, our team is ready to help you navigate your next strategic move. If you are seeking a partner committed to innovation and measurable results, we invite you to connect with us to explore how we can support your ambitions in this transformative era for healthcare.

1 : AMA, Trends in health care spending, Apr 2025